Brookfield Renewable (BEPC)·Q4 2025 Earnings Summary

Brookfield Renewable Delivers Record Year as Nuclear, Hydro, and Battery Bets Pay Off

January 30, 2026 · by Fintool AI Agent

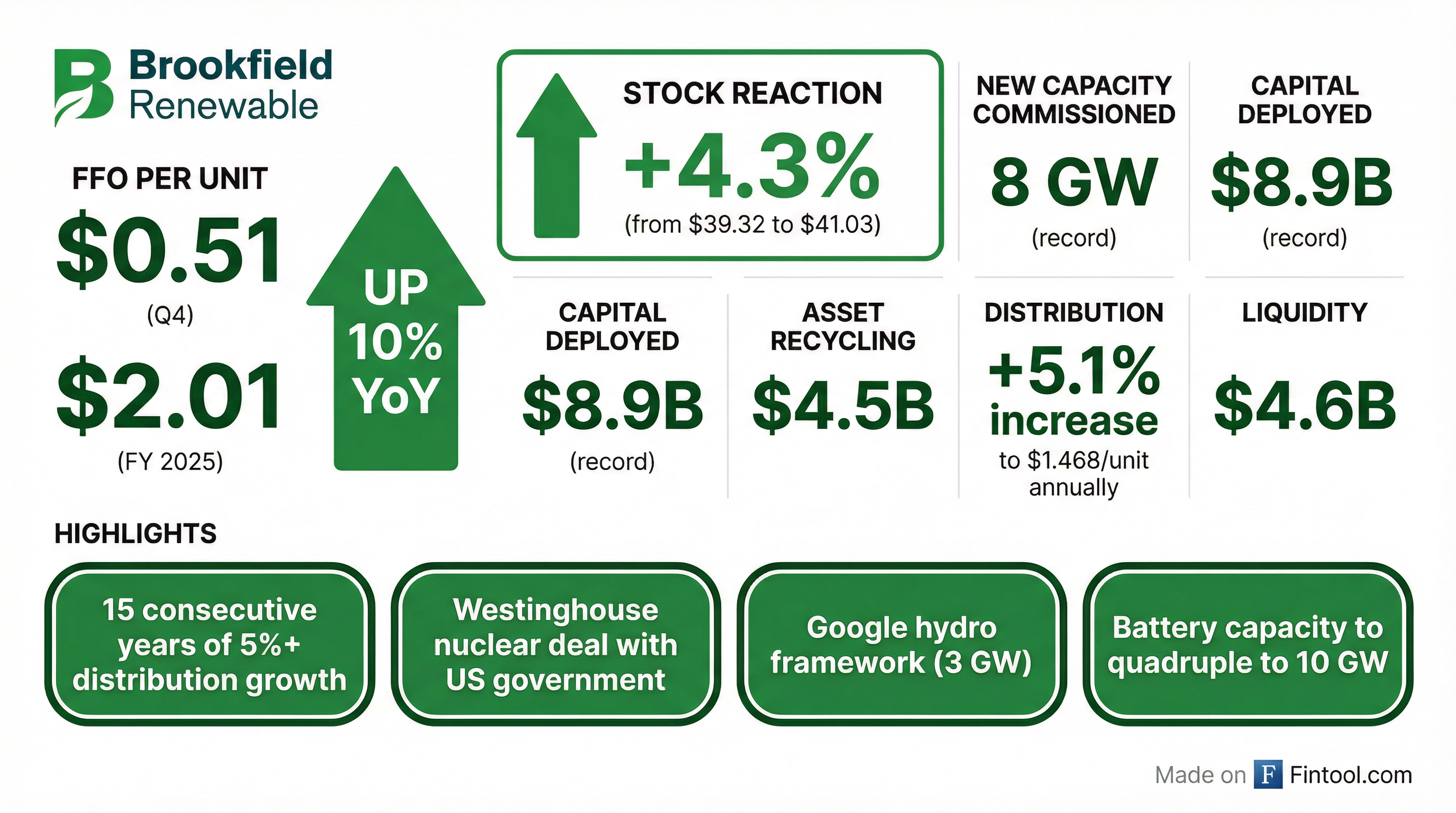

Brookfield Renewable Corporation (BEPC) delivered a strong Q4 2025, capping off a record year with FFO per unit of $2.01—up 10% year-over-year and in line with its long-term growth target . The stock rallied 4.3% following the earnings release as investors reacted to record capital deployment, expanding hyperscaler partnerships, and the company's deepening position in nuclear through Westinghouse.

Did Brookfield Renewable Beat Earnings?

Brookfield Renewable reports FFO (Funds From Operations) as its primary metric rather than traditional EPS, given the nature of its infrastructure assets. The company's key financial metrics for Q4 2025 and full-year 2025:

The 10% FFO per unit growth was driven by contracted inflation-linked cash flows across its diversified global fleet, growth from development activities, accretive acquisitions, and scaling capital recycling .

What Did Management Guide?

Management maintained its 12%-15% long-term total return target and reiterated confidence in continued growth . Key forward guidance:

- Distribution Growth: Announced 5%+ increase to $1.468 per unit annually—marking 15 consecutive years of at least 5% annual distribution growth

- Development Run Rate: On track to reach ~10 GW of new capacity per year by 2027

- Battery Storage: Expected to quadruple to over 10 GW within three years

- Capital Recycling: Scaled program with new framework to sell up to $1.5B of additional assets

What Changed From Last Quarter?

Several significant developments marked a step-change in Brookfield Renewable's positioning:

Nuclear: Westinghouse's U.S. Government Deal

The most impactful development was the landmark agreement between Westinghouse (a Brookfield Renewable subsidiary) and the U.S. government to deliver new nuclear reactors in the United States . This agreement:

- Delivers significant economic value via reactor development and long-term fuel/maintenance services over 80+ year reactor lifespans

- Provides long-term demand certainty that helps unlock supply chain investment

- Positions Westinghouse to expand beyond this initial program to both U.S. and international markets

CEO Conor Teskey emphasized this is happening against a backdrop of "reinvigorated nuclear sector, with increasing recognition of the role nuclear can play to enable economic growth and provide energy security" .

Hydro: Hyperscaler Demand at All-Time High

The scarcity value of hydroelectric power has reached "an all-time high" according to management . Key developments:

- Three 20-year PPAs signed with hyperscalers at strong pricing—a first for the business

- Google Framework Agreement: Up to 3 GW of hydro generation in the United States

- Higher contracted power prices coming as new contracts layer in over the next few years

Battery Storage: Fastest Growing Segment

Battery costs have declined 95% since 2010 and 60%+ in just the last 24 months . Brookfield is capitalizing with:

- A 1 GW+ standalone battery project in partnership with a sovereign wealth fund—one of the largest globally

- Expected quadrupling of battery capacity to 10 GW over three years

- Shift from merchant/arbitrage revenue models to long-term tolling/capacity contracts

Key Management Quotes

On the energy market transformation:

"We have shifted from a period focused on energy transition to a period focused on energy addition." — Conor Teskey, CEO

On hyperscaler demand:

"The demand we are seeing from corporates, and in particular, the large hyperscalers, is at an all-time high. And I recognize that we've been saying that for a number of years, but that demand just continues to accelerate and continues to grow." — Conor Teskey, CEO

On battery economics:

"Battery costs have come down so dramatically over the last decade... more than 60% over the last 24 months, and as a result, they are becoming an increasingly economic solution in more and more markets around the world." — Conor Teskey, CEO

Segment Performance

The company delivered strong results across all major segments:

The standout was the Distributed Energy, Storage, and Sustainable Solutions segment, nearly doubling year-over-year driven by organic development, the Neoen acquisition, and continued strength at Westinghouse.

Capital Deployment and Recycling

Brookfield Renewable set records on both sides of the ledger:

Capital Deployed/Committed: $8.9B ($1.9B net to BEP)

- Neoen privatization

- Geronimo Energy carve-out in the U.S.

- Increased investment in Isagen

Asset Recycling: $4.5B ($1.3B net to BEP) at returns above target

- North American distributed energy platform sale

- 50% interest in U.S. non-core hydro portfolio

- $1B in enterprise value sold at Neoen in first year of ownership

New Framework: Agreement to sell two-thirds stake in a portfolio of operating wind/solar assets for $860M ($210M net) plus a framework for up to $1.5B of additional asset sales .

Balance Sheet Strength

Brookfield Renewable maintained its fortress balance sheet:

Notable financing achievements:

- CAD 450M 10-year notes at lowest spread in nearly 20 years

- CAD 500M 30-year notes at lowest spread ever

- $650M bought deal equity raise in November

How Did the Stock React?

BEPC shares rose 4.3% on the day of the earnings release, moving from $39.32 to $41.03. The positive reaction reflects:

- Record operational metrics meeting long-term targets

- Nuclear positioning through Westinghouse gaining strategic importance

- Hyperscaler partnerships expanding (Microsoft, Google)

- Continued distribution growth track record

- De-risked capital recycling with new frameworks

The stock is up significantly from its 52-week low of $23.73, though still below the 52-week high of $45.10.

Q&A Highlights

On Microsoft Partnership (Sean Stewart, TD Cowen): Management confirmed 2026 will see growth from the Microsoft framework agreement, with expectations to "do nothing but accelerate from 2026 through the rest of the decade." Microsoft is now seeking power across a "broader spectrum of regions and markets, particularly across the United States" .

On U.S. Permitting (Nelson Ng, RBC): Solar development is seeing "no slowdown... an acceleration" in the U.S. Onshore wind has experienced some federal permitting slowdown but "projects are still getting done" .

On M&A Opportunities (Balte Sidhu, National Bank): Management sees three key opportunity areas: (1) public companies, (2) carve-outs from utilities with capital constraints, and (3) smaller developers with large pipelines but limited scale capabilities .

On Offshore Wind (Benjamin Pham, BMO): Europe is "increasingly more constructive" for offshore wind, and Brookfield is evaluating opportunities, including potentially acquiring end-of-contract assets that could be re-contracted .

Forward Catalysts

- Nuclear Execution: Progress on Westinghouse reactor deployments and additional government/corporate commitments

- Hydro Contracting: New PPAs layering in at elevated pricing over next 2-3 years

- Battery Scale-Up: Quadrupling capacity to 10 GW with contracted revenue profiles

- Capital Recycling Frameworks: Execution on $1.5B framework and expansion to other regions

- 2027 Development Target: Reaching 10 GW/year new capacity commissioning run rate

- Brookfield Global Transition Fund II: $20B+ in capital to support large-scale investments alongside BEP

The Bottom Line

Brookfield Renewable delivered exactly what shareholders have come to expect: consistent 10% FFO per unit growth, continued distribution increases, and disciplined capital allocation. The more meaningful story is the strategic positioning—the company now sits at the intersection of nuclear (Westinghouse), hydro (scarcity value), and battery storage (fastest-growing segment) just as AI-driven energy demand is inflecting sharply higher. The Westinghouse nuclear deal with the U.S. government could be transformational over a multi-decade horizon. For investors seeking yield plus growth in the energy transition (now "energy addition" per management), BEPC remains a core holding.

View more on Brookfield Renewable | Q4 2025 Transcript